Allianz USD Fixed Income Fund

Currency:

USD (United States Dollar)

Allianz USD Fixed Income Fund aims to generate income by investing primarily in USD denominated bonds issued by the Indonesia government or corporates within Indonesia, with up to 15% of the fund’s NAV invested in USD denominated bonds issued/traded outside of Indonesia.

Investment Policy

-

Minimum of 80% and a maximum of 100% of the Net Asset Value of debt Securities tradable either onshore or offshore

-

Minimum of 0% and maximum of 20% of the Net Asset Value of onshore money market instruments issued with a maturity of less than 1 year and/or deposits;

In accordance with the prevailing legislations in Indonesia

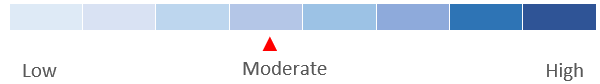

Investment Risk classification

Key Facts

| Fund category | Fixed Income |

| Launch date | 2 October 2023 |

| Custodian Bank | PT Bank HSBC Indonesia |

| Initial Offering Unit Price | USD$ 1.00 (one) U.S. Dollar |

| Minimum Initial Investment | USD$ 10,000 (ten thousand) U.S. Dollar |

| Minimum Additional Investment/ Top Up | USD$ 100 (ten thousand) U.S. Dollar |

Fees

|

Type |

Fee |

|

Management fee |

Max. 3 % |

|

Custodian fee |

Max. 0.3 % |

|

Subscription fee |

Max. 2 % |

|

Redemption fee |

Max. 2 % |

|

Switching fee |

Max. 1 % |

Documents

|

28/03/2024

|

||

|

01/10/2023

|