Corporate Governance

To fulfill our commitment as an Investment Manager company that has Good Corporate Governance (GCG), we ensure that all business and operational scopes of PT Allianz Global Investor Asset Management Indonesia are in accordance with the applicable laws and regulations. In this case, in accordance with the Law of the Republic of Indonesia No. 40 of 2007 concerning Limited Liability Companies, Financial Services Authority Regulations (OJK) concerning Investment Manager Licensing, Implementation of Investment Manager Governance and the Articles of Association of PT Allianz Global Investors Asset Management Indonesia.

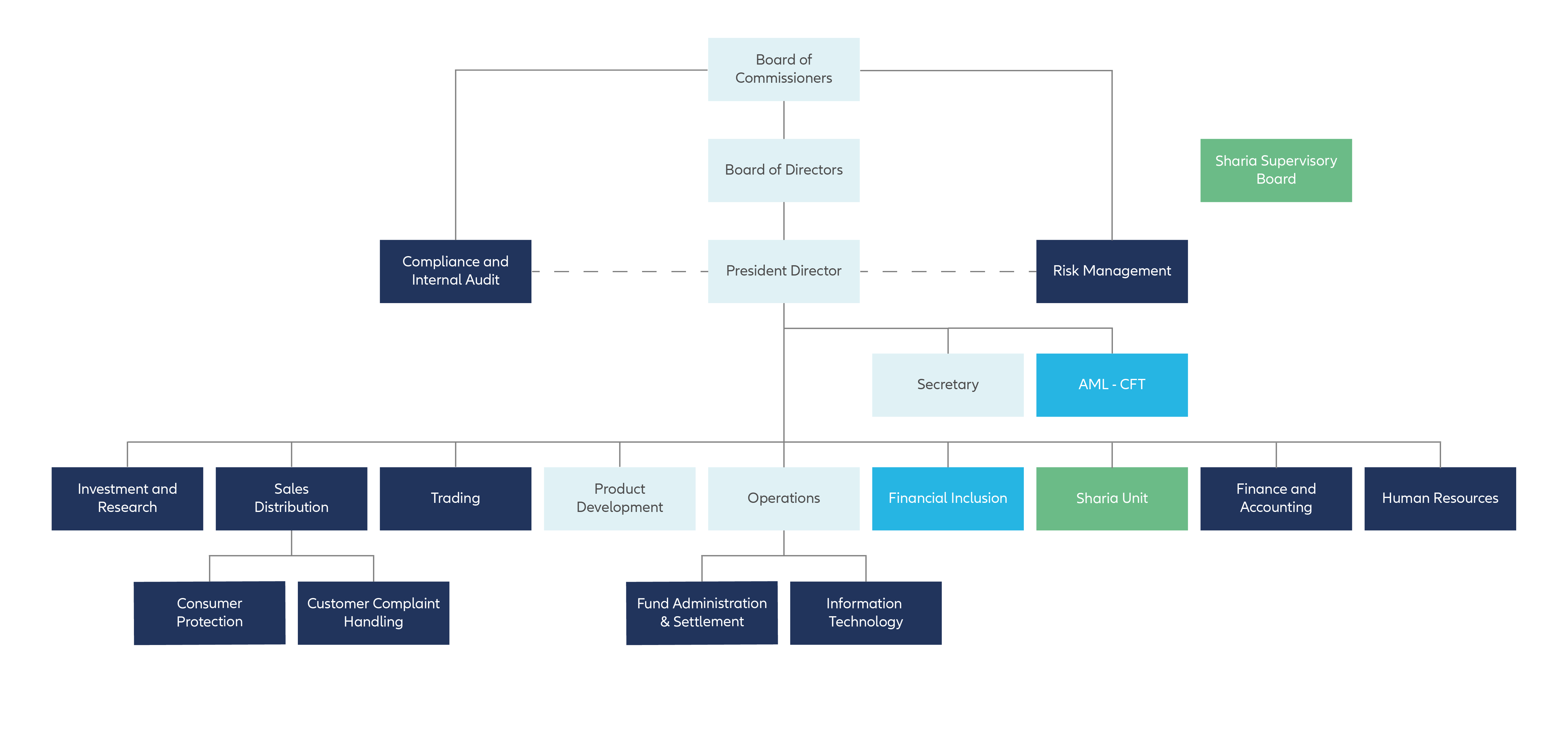

Organizational structure

Main working guidelines of the Board of Directors

and the Board of Commissioners

The implementation of the duties of the Board of Commissioners and the Board of Directors refers to the Work Guidelines for the Board of Commissioners and the Board of Directors, which regulates the procedures for implementing the work of the Board of Commissioners and the Board of Directors. The Work Guidelines for the Board of Commissioners and the Board of Directors are prepared in accordance with the Law of the Republic of Indonesia No. 40 Year 2007 about Limited Liability Companies, Financial Services Authority Regulations concerning Investment Manager licensing, Implementation of Investment Manager Governance, and the Articles of Association of PT Allianz Global Investors Asset Management Indonesia.

Board of Commissioners

Board of Directors

Sharia Supervisory Board

Code of Ethics

The Code of Ethics is applied to all PT Allianz Global Investors Asset Management Indonesia Employees in order to improve compliance with internal and external regulations of the company. Sanctions will be applied consistently to all employees that are proven to have deviations and violations of internal & external provisions as well as the Company's internal code of ethics. Please refer to our Code of Ethics:

A. The Value of the Company

As a securities company that manages assets on behalf of the customer and related with stakeholders in activities its business, PT Allianz Global Investors Asset Management Indonesia sets and implements a code of ethics for demonstrate its commitment to ethical and professional behavior, and protection of stakeholder interests. In addition, the Code of Conduct for Allianz Group is the manifest of our commitment to all stakeholders

B. PT Allianz Global Investors Asset Management Indonesia Commitment and Principles at all times:

- behave professionally and respectfully ethics;

- act in the interests of the Customer;

- be independent and objective;

- skilled, competent, and thorough;

- communicate with customers directly timely and accurate;

- uphold the provisions of the capital market applicable.

C. Handling Violations & Accountability For Imposition of Sanctions For Violations Of The Code Of Ethics

The Code of Ethics applies to all employees of PT Allianz Global Investors Asset Management Indonesia to improve compliance with internal and external regulations. Sanctions are applied consistently to all employees that are proven to have violated and violated internal and external regulations as well as the Company's internal code of ethics.

Risk Management, Compliance, and Internal Audit

PT Allianz Global Investors Asset Management Indonesia Compliance, Risk Management and Internal Audit function.

Purpose of Compliance, Risk Management and Internal Audit function:

- Support a strong compliance culture and improve compliance awareness.

- Support a culture of strong risk management and risk awareness.

- To maintain and supervise the compliance strategy and ensure the operational of business run in accordance with applicable laws and regulations.

-

Implementation of internal control with the three lines of defense model:

- First line that responsible to managing the risk in running business processes effectively and efficiently in accordance with the strategies and regulations set by the Company – The owner and business operational team.

- Second line responsible to ensuring compliance with the implementation of company functions with applicable laws and regulations, operational policies and procedures and also helping company functions in managing risks and also running the business in order to achieve a balance between the business and risk - Risk management and compliance.

- Third line responsible for the assessment of the adequacy of control design and implementation of controls both in the First Line and in the Second Line in managing risks which are very important to achieve the Company's business objectives in accordance with the principles of Good Corporate Governance – Internal audit.