Allianz Fixed Income Fund 2

Currency:

IDR (Indonesian Rupiah)

The investment objective of Reksa Dana Allianz Fixed Income Fund 2 ("Allianz Fixed Income Fund 2") is to provides attractive investment return through active portfolio management in Debt Securities that have obtained rating from the securities rating company registered in OJK and categorized as Investment Grade.

Investment Policy

-

minimum 80% and maximum 100% of the Net asset value in Debt Securities Issued By Government and / or State-Owned Enterprises Categorized Investment Grade;

-

minimum 0% and maximum 20% of the net asset value in domestic money market instruments with time to maturity less than 1 year and/or deposit;

In accordance with applicable legislations In Indonesia.

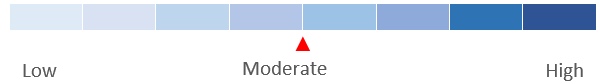

Investment Risk classification

Key Facts

| Fund category | Fixed Income |

| Launch date | 20 Jul 2016 |

| Custodian Bank | PT Bank Rakyat Indonesia (Persero) Tbk |

| Initial Offering Unit Price | IDR 1.000 |

| Minimum Initial Investment | IDR 100,000 |

| Minimum Additional Investment/ Top Up | Not Specified |

Fees

|

Type |

Fee |

|

Management fee |

Max. 2 % |

|

Custodian fee |

Max. 0.2 % |

|

Subscription fee |

Max. 2 % |

|

Redemption fee |

Max. 2 % |

|

Switching fee |

Max. 2 % |

|

Document

|

Date

|

Actions

|

|---|---|---|

|

30/01/2026

|

|

|

|

27/03/2025

|

|